Investing Blueprint to Maximize Tax Deductions

401K, IRAs, HSA, Broker account, High yield savings account. with so many options, it’s only natural to be confused as to which accounts to have and where to start investing to get the most bang for your buck. In this article, I'll help you determine where to start, which ones to focus on, and eliminate any doubts you may have.

Before we get into the investing blueprint, it is always a good idea to complete the following 3 steps, which will overall help you in your financial journey. Before investing, you should:

Pay down all consumer debt (exclude mortgage)

Fully fund an emergency fund to cover 3 to 6 months of living expenses

Create an Intentional Budget, rooted in your values and priorities in life

Investing Plan:

1. 401K Up To The Company Match:

The first account you'll want to contribute to, if you have access to it, is your employer’s 401K. Most employers offer you what’s called a company match, which means if you contribute say 10% of your paycheck into your 401K, your employer will contribute an additional 5% for example (this would be a 50% match). Sounds meaningless, but it’s actually the easiest and most effortless 50% gain you'll ever make AND you haven't even started investing. Find out if your employer offers a match, what is the percentage, and contribute the minimum you need to, in order to get the full match, and I'll explain later why it’s important to stop here.

401Ks are tax advantage accounts and most employer-sponsored plans work on pre-tax dollars (very few offer Roth 401K options), meaning you don't pay taxes on the money you put in, until you decide to take the money out during retirement.

Some companies have what's called a vesting period and in order for you to own the free money they are giving you (the company match), you need to meet some basic requirements such as working for them for 2 years. Once you meet the requirement, you are considered "fully vested" and you own all of that money.

Homework: Ask your employer if they have a company match and vesting requirements

2. Roth IRA: Max

The second account you want to contribute to is a ROTH IRA. This is also a tax advantage account, but it works in the opposite manner, as you contribute dollars that the IRS has already taxed from your paycheck, but all the money you contribute will grow tax-free. This means you won't have to worry about the IRS ever touching this account so we want to max it out.

However, two things you need to know. 1) you'll need to open this account on your own at Vanguard, Fidelity, or Schwab but be aware of current contribution limits for 2025 of $7,000 per year if you are under the age of 50, or $8000 if 50 or older. The second thing is that in order to qualify for this account you will need to be below the MAGI-Modified Adjusted Gross Income based on tax filing status. For single filers, the limit is making less than $150,000. For married filing jointly it’s less than $236,000. But remember this is Modified Adjusted Gross Income, not your salary. MAGI is usually calculated by taking your Gross salary minus any deduction and credits plus untaxed foreign income, non-taxable social security benefits, and tax-exempt interest (consult a tax professional to find your exact MAGI or review your tax documents for prior years).

Source: IRS website

3. 401K: Max-out

The 3rd account we want to contribute to is actually the same account we discussed at the beginning which is the 401K. In step one we contributed the minimum amount needed in order to get the company match. However, now that we have maxed out the ROTH IRA, we want to go back to the 401K and also max it out. For 2025, its contribution limit is $23,500 per year, with a catch-up contribution of $7500 if you are over the age of 50

We want to maximize these accounts first as they are telling the IRS: HEEEEY ! Keep your hands off my money and only tax it once, and not twice.

Remember that reducing the amount of money you are paying on taxes means you can use that money to get out of debt, go on vacation and build memories with friends and family, or take on a new hobby, or like me, pursue early retirement.

Source: IRS website

4. Broker Account:

Lastly, we want to put all additional investment dollars in a broker account, which unfortunately is a 100% taxable account, but if you followed steps 1 through 3, you already put away Over $30,000 per year in tax advantage accounts + a company match.

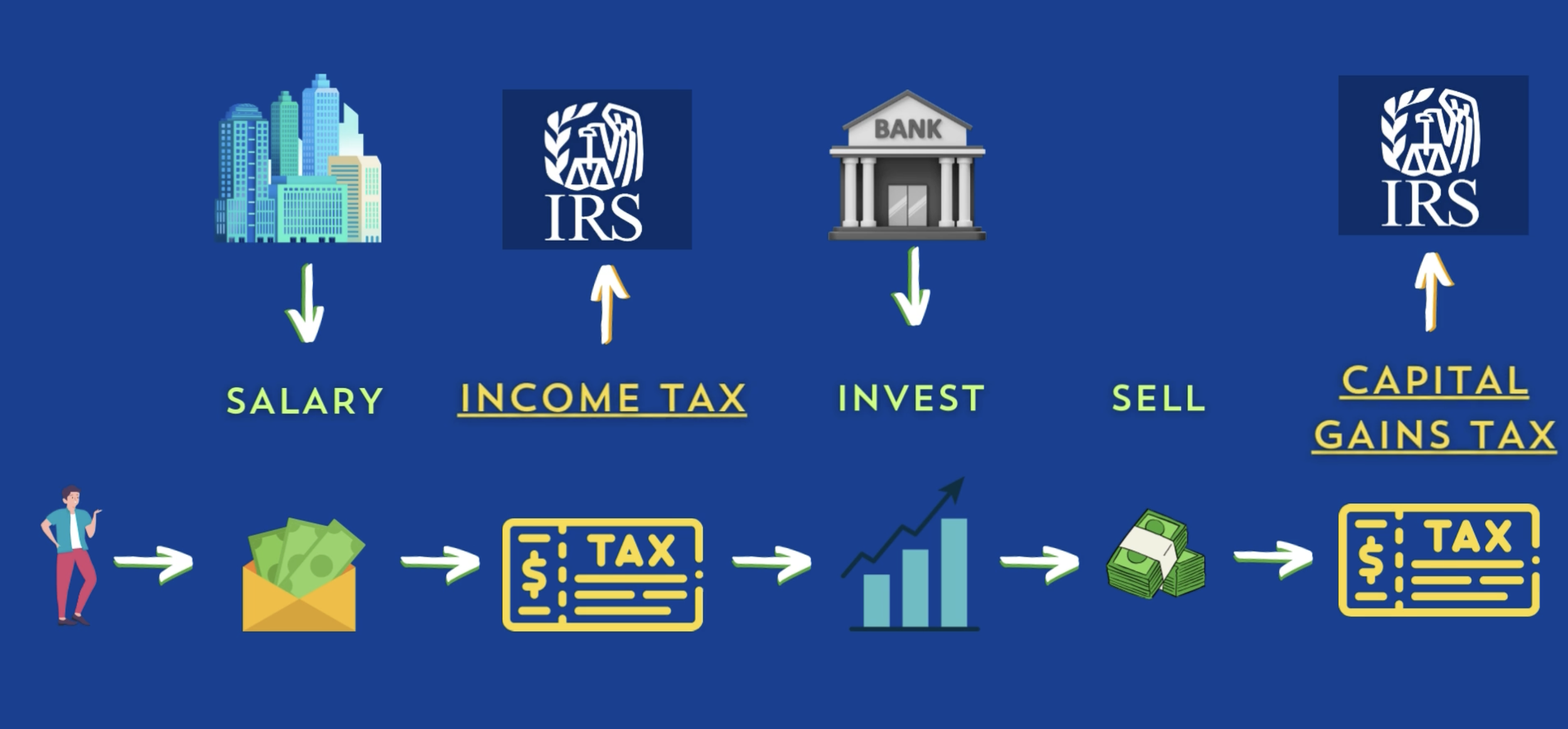

When I say 100% taxable, I mean that you will contribute money from your paycheck which the IRS already taxed once as ordinary income, and any growth this money experiences while it is invested will later be taxed a second time by the IRS when you sell the investments. This second round of taxes is called “Capital Gains”. How much you pay in taxes is dependent on the amount of time you actually held the investment, but in general terms, if you hold an investment for over 12 months (long-term capital gains) your tax liability will be lower. As you already know, I don’t recommend day trading or market timing, therefore we won’t be holding an investment for less than 12 months (short-term capital gains).

Like the Roth IRA, you can open this type of account in a major firm like Vanguard, Fidelity, or Schwab.

5. High Yield Savings Account:

The last account I would consider having simply to fight inflation is a High Yield Savings account. Now, these accounts are not going to make you a whole lot of money but they are a great option to park your emergency fund or money you will need in the near future such as the down payment for a home, and that you want to protect. You can open one of these accounts with pretty much any bank and in return they will give you a variable interest rate on your money and they are guaranteed by the FDIC. Remember we are not trying to get rich a HYSA, simply make a little extra from the money we already have and will be spending in the near future. Since we need this money in the near future, it doesn’t make sense to invest it in the stock market due to market volatility.

If you've been around my channel, you know that before you jump into doing any kind of investing you need to have a budget. A clear plan that tells every dollar what to do, and what's its purpose. I have a free template you can download on my website’s footer section.